Is It Too Late To Consider ArcelorMittal (ENXTAM:MT) After A 93% One Year Rally

February 1, 2026 - 12:51

ArcelorMittal's stock has delivered staggering returns to shareholders, surging 93% over the past year alone. This remarkable rally naturally leads investors to question whether the steel giant's equity still presents a compelling opportunity or if the easy gains have already been made.

The numbers paint a picture of sustained momentum. Shares recently closed at €45.98, reflecting strong performance across multiple timeframes: a 15.4% gain year-to-date, a 69.3% return over three years, and an impressive 166.0% climb over five years. This performance trajectory forces a reevaluation of both the potential upside and the inherent risks at current valuation levels.

Market attention has recently centered on the company's strategic direction and operational performance. While the past performance is undoubtedly strong, the critical investment thesis now hinges on future profitability, global steel demand, and the company's ability to navigate economic cycles. The central dilemma for investors is determining if the current share price already reflects future growth prospects or if ArcelorMittal's fundamentals justify further appreciation. Careful analysis of earnings, sector trends, and broader economic indicators is essential before making any investment decision.

MORE NEWS

January 31, 2026 - 21:27

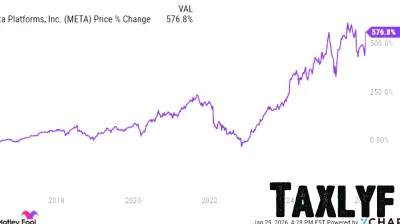

Meta Platforms: A Decade-Long Winner Trading at a BargainDespite delivering staggering returns for long-term investors, Meta Platforms Inc. often finds itself undervalued by the broader market. Over the past ten years, the social media giant`s stock has...

January 31, 2026 - 05:01

Accelerating Convergence Between Traditional and On-Chain Finance in 2026?The financial landscape is on the cusp of a profound transformation, with 2026 emerging as a pivotal year for the integration of traditional and blockchain-based finance. Industry observers are now...

January 30, 2026 - 00:20

First Financial Bancorp.: Continued MomentumFirst Financial Bancorp. has closed the fourth quarter with significant momentum, showcasing robust financial health and exceeding market expectations. The company announced a substantial 12.1%...

January 29, 2026 - 10:59

Houlihan Lokey Inc (HLI) Q3 2026 Earnings Call Highlights: Strong Revenue Growth Amid Market ...Investment banking firm Houlihan Lokey Inc. (HLI) has announced strong financial results for its third fiscal quarter, highlighting significant revenue growth and strategic maneuvers in a complex...